Kapitalmarkt

20.10.2017

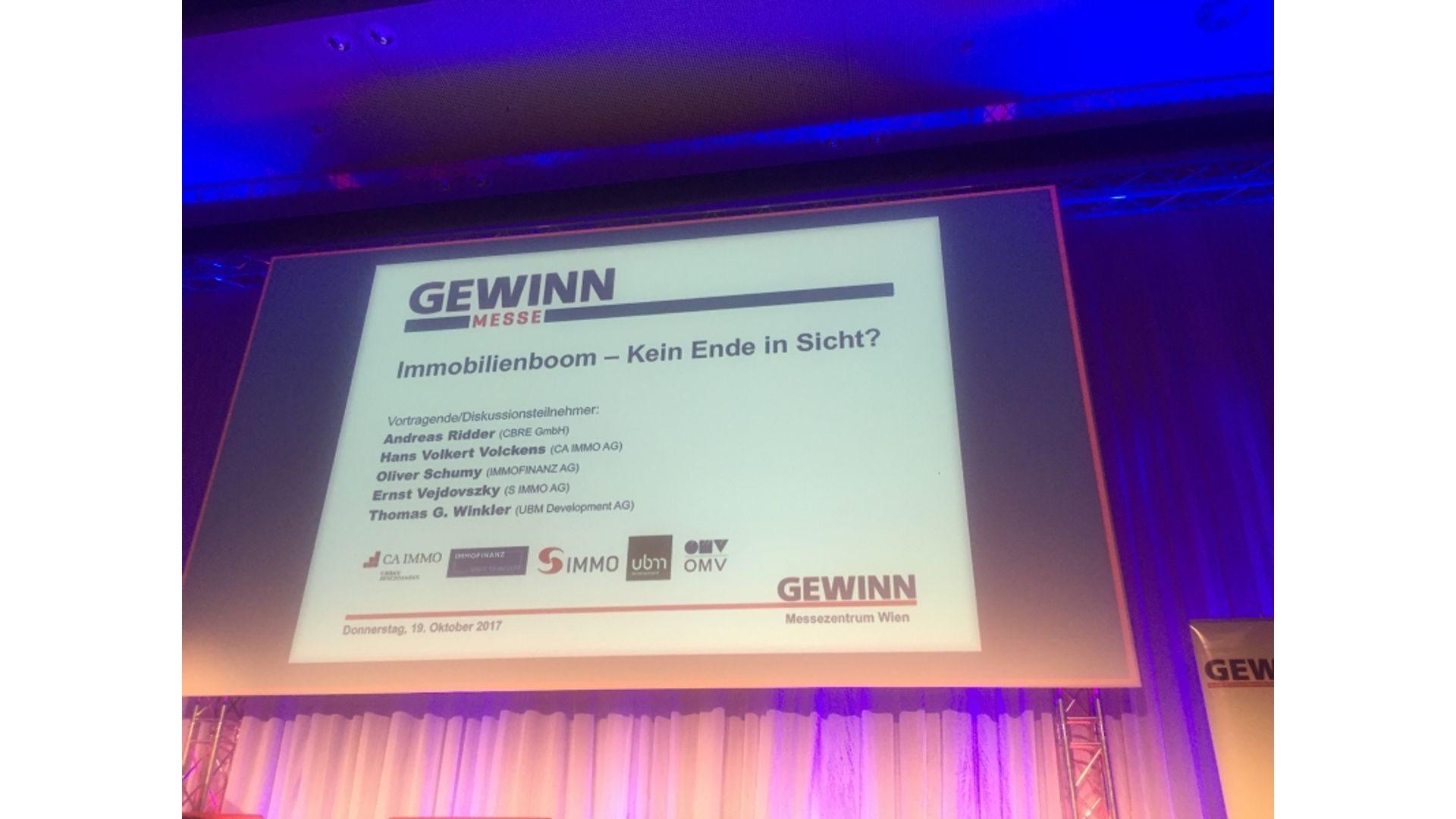

IMMOFINANZ at the Gewinn Trade Fair: “Not quite enough shareholders for an annual general meeting, but still.....“

“How many of you are IMMOFINANZ shareholders“, was the first question Gewinn publisher Georg Wailand asked the Gewinn Trade Fair visitors who had gathered to hear an interview with CEO Oliver Schumy. “Not quite enough shareholders for an annual general meeting, but still....“, added Wailand in a good-natured reaction to the numerous hands raised in the crowd.The Gewinn publisher started with a question on developments in recent months, and CEO Schumy mentioned the sound improvement in the occupancy rate (roughly 93% across the entire portfolio) as well as the savings realised in financing and operations. The volume of bonds with historically high interest rates (originally, almost one billion Euros) was substantially reduced and future financing costs were cut by more than EUR 21 million. With the convertible bond 2024, IMMOFINANZ now has only one larger bond with a volume of nearly 300 million Euros outstanding.

The strict focus of the portfolio on brands – myhive for offices and STOP SHOP and VIVO! for retail parks and shopping centers – is functioning very well, which can also be seen in the improvement of the occupancy rate. For example: the VIVO! shopping center which opened in the Polish city of Krosno at the end of September was fully rented by the very first day.

Gewinn publisher Wailand also had a personal anecdote to tell about our VIVO! brand: one of his grandchildren recently had a part in a photo shooting for a VIVO! advertising campaign.

“Yes, our brand marketing is now uniform and central“, explained Schumy. The IMMOFINANZ brands are based on high standardisation – which is also reflected in the advertising. That saves costs and, at the same time, leads to better coverage and accuracy. STOP SHOP was the starting point, and the VIVO! Campaign will be rolled out shortly – just in time for the Christmas shopping season. Wailand promises to follow the campaign in detail: “That shows your intention to follow a clear line“.

Another important step is the expansion of the STOP SHOP retail park chain. “This product still has enormous market opportunities in many of our portfolio countries. With a rental yield of 7.5% to 8%, it is also a very profitable product that not everyone has“, commented the CEO on further growth.

Concerning the planned separation of the Russian portfolio, Schumy emphasised the recently communicated schedule, which calls for the completion of this process by the end of this year. Advanced discussions are currently in progress with one bidder, but there are also other interested parties. The separation of the Moscow portfolio is step one, CA Immo will then be the next step.

Schumy also mentioned a recent European trend in the real estate sector – the creation of increasingly larger units. This will be a necessary development in the coming years, indicated the CEO and referred to the full implementation of Basel 4, which could result in banks requiring more equity for real estate loans, and to the rising construction cost index. “And a company has to manage all this financially“. Larger companies naturally have an advantage, also in more favourable financing alternatives on the bond market.

With regard to dividends, the CEO confirmed IMMOFINANZ’s positioning as a sustainable dividend stock. A dividend of EUR 0.06 per share is planned for the current financial year.

The strict focus of the portfolio on brands – myhive for offices and STOP SHOP and VIVO! for retail parks and shopping centers – is functioning very well, which can also be seen in the improvement of the occupancy rate. For example: the VIVO! shopping center which opened in the Polish city of Krosno at the end of September was fully rented by the very first day.

Gewinn publisher Wailand also had a personal anecdote to tell about our VIVO! brand: one of his grandchildren recently had a part in a photo shooting for a VIVO! advertising campaign.

“Yes, our brand marketing is now uniform and central“, explained Schumy. The IMMOFINANZ brands are based on high standardisation – which is also reflected in the advertising. That saves costs and, at the same time, leads to better coverage and accuracy. STOP SHOP was the starting point, and the VIVO! Campaign will be rolled out shortly – just in time for the Christmas shopping season. Wailand promises to follow the campaign in detail: “That shows your intention to follow a clear line“.

Another important step is the expansion of the STOP SHOP retail park chain. “This product still has enormous market opportunities in many of our portfolio countries. With a rental yield of 7.5% to 8%, it is also a very profitable product that not everyone has“, commented the CEO on further growth.

Concerning the planned separation of the Russian portfolio, Schumy emphasised the recently communicated schedule, which calls for the completion of this process by the end of this year. Advanced discussions are currently in progress with one bidder, but there are also other interested parties. The separation of the Moscow portfolio is step one, CA Immo will then be the next step.

Schumy also mentioned a recent European trend in the real estate sector – the creation of increasingly larger units. This will be a necessary development in the coming years, indicated the CEO and referred to the full implementation of Basel 4, which could result in banks requiring more equity for real estate loans, and to the rising construction cost index. “And a company has to manage all this financially“. Larger companies naturally have an advantage, also in more favourable financing alternatives on the bond market.

With regard to dividends, the CEO confirmed IMMOFINANZ’s positioning as a sustainable dividend stock. A dividend of EUR 0.06 per share is planned for the current financial year.